Another departure from the usual Elegant Economist style - this post was inspired by this awesome In Our Time episode. Hope you enjoy!

A tempestuous subduction zone in the India Ocean, Shelly’s Mask of Anarchy, and The Guardian – what on earth do they have in common?

This is quick, and hopefully entertaining, story to illustrate just how intricate and interconnected the world can be.

At a time when politicians are telling us there are 10-word answers to the immense challenges we face, it is useful to reflect just how complicated the world we live in really is. We so rarely understand, or even can understand, the implications of the actions we now take. So we should be wary indeed of politicians offering us ‘simple solutions’. Instead we should demand leaders who understand the nuance and uncertainty of today.

But this is abstract – let me instead start my story. One that will weave together geology, meteorology, politics, poetry and history.

It begins 340 kilometres north of the Java Trench, where the Indo-Australian Plate meets the bloc of the Eurasian Plate. Strictly speaking it’s where the Indo-Australian Plate gets subsumed by the Eurasian plate and is pushed beneath the Eurasian plate forming a subduction zone. A LOT of tectonic activity takes place here – think molten lava. 57,000 years ago all this activity formed a volcano called Mount Tambora, which eventually reached a height of 4,000 metres.

Unfortunately for the people of Tambora, it didn’t stay this high.

The rich magma building up under its cone was andesitic in composition. This type of magma emits copious quantities of gas but with nowhere to go. Pressure built until eventually it was all too much for poor Mount Tambora. It erupted. Spectacularly.

The eruption of Mount Tambora in 1815 lasted 3 days and is suspected to be the most destructive blast in 10,000 years. At its peak it is estimated to have been discharging material at rate of 300-500 million kilograms per second. 10,000 people died directly from the blast while a further 80,000 in the region are thought to have later perished from starvation.

Why starvation? This is where geology meets meteorology. Much of what Tambora shot up was sulphur dioxide, and, it turns out, if you shoot it high enough it can hang around for a pretty long time. (We’re talking years here). Up in the stratosphere it partially obscures the sun rays as well as increasing the solar reflection. Less sun, less heat. This doesn’t affect Indonesia so much as, well everyone.

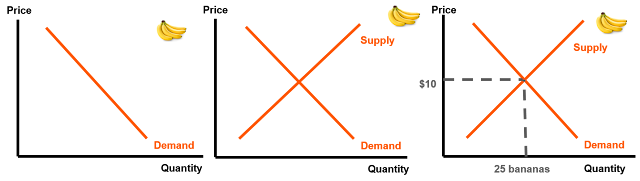

Europe had already been going through of a cold snap known as the Little Ice Age. Tambora’s eruption exacerbated this. 1816 became known as the year without a summer, with snow falling in June in Central Europe. Quite apart from being depressing, it played havoc with agriculture. Cool temperatures and heavy rains resulted in failed harvests in Britain, Ireland and much of continental Europe. The price of bread doubled and many farmers abandoned their land, becoming refugees in their own country. It was the worst famine of the 19th century.

And this is where meteorology meets politics.

The result was that people were increasingly dissatisfied. But the climate wasn’t the only cause. The import-restricting Corn Laws amplified famine and unemployment in the North of England, as did the dip in textile manufacturing. This backdrop intensified anger at the political system, particularly the so called rotten boroughs. While major urban centres like Manchester with over 1 million citizens were represented by only two MPs, Old Sarum in Wiltshire elected two MPs with just 1 voter. Voting was also restrictive. Only property owners with an annual rental value of 40 shillings, could cast a ballot.

On August 16th, at St. Peter’s Field 60,000 protestors gathered to protest at their lack of representation. This was considered illegal and warrants were issued for the arrests of the protest organisers. But getting to them wasn’t going to be easy as they were in the very centre of the crowd. Calvary officers, who were later accused of being poorly trained and, perhaps, drunk, charged the crowds in an attempt to get to Hunt and other leaders as well as to disperse the crowd. This they did, but not before killing 15 people and injuring upward of 500.

Meanwhile, the poet Percy Shelley, who had written about the strange weather of 1816 while on the shores of Lake Geneva, heard of the massacre only in September while in Italy. His response was the wonderful poem, the Mask of Anarchy, only published after his death. This mesmerising poem is even better listened than read. (I once heard a version read by Dominic West which was incredible but sadly I can no longer find).

In the poem Shelley calls out the senior government ministers such as the Viscounts Castelreigh and Sidmouth who defended their harsh response to Peterloo. They are represented by a number of characters; Murder, Fraud, Hypocrisy (riding on a crocodile no less), and Anarchy astride a white steed, echoing the four horsemen of the apocalypse. They, with Anarchy in the lead, lay siege to Britain under his banner "I am God, and King, and LAW". In this way Shelley represented the repression felt by an increasingly literate and empowered working class who consistently saw political decisions being made which favoured the elite at their expense. While it begins with their subjugation the poem ends with their eventual triumph over these "destructions". It is an ode to a democracy -"Let a great assembly be, of the fearless and the free" - that would take another 112 years to fully form.

In the third-to-last stanza of the poem, Shelley describes what he hoped the impact of Peterloo would be; "And that slaughter to the Nation, shall steam up like inspiration, eloquent, oracular; a volcano heard a far". Shelley did not know about Tambora, nobody in Europe did at that time. It would be at least 150 years before scientists began to piece the connections together. But in some respects The Mask of Anarchy, the Guardian and indeed British democracy owe something to "a volcano heard a far".

I said at the beginning that this was a story about the interconnection of things. Tambora wasn't the sole or even major cause of these changes. Instead it and other preceding events combined to create the chaos of August 16th, 1816.

And it is this ability to see complexity behind events which is so essential in our understanding of the modern world. Globalisation has only increased the links between people and systems. While this has created huge benefits such as rising life expectancies and falling poverty rates it has also intensified risks. Where sectors are tightly coupled, trouble in one area spreads too rapidly to destabilise other systems. We saw this in the financial crash of 2007-2008 - its fatal speed owed much to a system where many of the institutions were so interdependent that a failure in one inevitably set off a downward spiral that virtually brought down the entire financial sector.

Yet the point is not to try and stop this increasing interconnectivity, but to understand it. To take a step back from situations and events and reflect on the many different, and at first sight seemingly unrelated, causes. Only by understanding these, can we fully appreciate the scale and complexity of problems and determine smart solutions.

This is a lesson for us all, and not just for our political and business leaders. We have the global smarts to deal with the next big challenges - an anti-biotic resistant super bug, mass migration caused by climate change or even another overwhelming volcanic eruption. But we can't use these smarts effectively unless we take a deep breath, step back and analyse the multiple and varied causes of the challenges we face.